Financial stress is a heavy burden, impacting not just your wallet but also your mental and emotional well-being. Whether it’s managing debt, living paycheck to paycheck, or navigating unexpected expenses, financial challenges can leave you feeling anxious, overwhelmed, and even physically unwell. Studies from the American Psychological Association reveal that 72% of adults report feeling stressed about money at least some of the time, making financial concerns the leading cause of stress in the United States.

Chronic financial stress isn’t just an emotional challenge—it’s a health issue. Research has linked financial anxiety to increased risks of depression, anxiety disorders, and heart disease. The good news is that with the right mental health strategies, you can learn to manage financial stress, build resilience, and create a healthier relationship with money. This guide provides actionable steps to help you take control of your finances while protecting your mental health.

The Impact of Financial Stress on Mental Health

Financial stress can feel all-encompassing, affecting every aspect of your life. Understanding its effects can help you recognize the urgency of addressing it.

1. Emotional Effects

- Anxiety and Worry: Constant fear about making ends meet or paying bills.

- Guilt and Shame: Feeling inadequate or embarrassed about your financial situation.

- Anger and Frustration: Resentment over financial pressures or mistakes.

2. Cognitive Effects

- Difficulty Concentrating: Preoccupation with financial problems can make it hard to focus on work or daily tasks.

- Impaired Decision-Making: Stress narrows your thinking, leading to impulsive financial choices.

3. Physical Effects

- Sleep Problems: Financial stress is a leading cause of insomnia, with 64% of adults reporting poor sleep due to money worries (National Sleep Foundation).

- Chronic Health Issues: Elevated cortisol levels (the stress hormone) can contribute to high blood pressure, heart disease, and weakened immunity.

Addressing financial stress isn’t just about improving your bank account—it’s about reclaiming your peace of mind and overall health.

Strategies to Overcome Financial Stress

The path to overcoming financial stress involves both practical money management and mental health strategies. Here’s how to take action:

1. Acknowledge and Accept Your Situation

The first step to managing financial stress is acknowledging your reality without judgment or avoidance. Denial only prolongs stress, while acceptance creates a foundation for problem-solving.

How to Start:

- Assess Your Finances: Write down your income, expenses, debts, and savings to get a clear picture of your financial health.

- Identify Triggers: Reflect on specific financial situations that cause the most stress, such as credit card debt or medical bills.

- Practice Self-Compassion: Remind yourself that financial challenges are common and not a reflection of your worth.

Example: If you feel ashamed about debt, acknowledge it without self-blame: “This is my current situation, and I’m taking steps to improve it.”

2. Develop a Financial Action Plan

Having a plan can significantly reduce stress by giving you a sense of control and direction.

Steps to Create a Financial Plan:

- Set Priorities: Identify your most urgent financial goals, such as paying off high-interest debt or building an emergency fund.

- Create a Budget: Use tools like Mint, YNAB (You Need A Budget), or simple spreadsheets to track your spending and allocate funds.

- Seek Professional Help: If overwhelmed, consult a financial advisor or nonprofit credit counselor for guidance.

Example: If credit card debt is your main concern, focus on strategies like the snowball method (paying off the smallest debts first) or the avalanche method (targeting high-interest debts).

3. Practice Mindfulness Around Money

Mindfulness can help you reduce financial anxiety by fostering a calm, nonjudgmental approach to your spending habits.

How to Practice Financial Mindfulness:

- Track Your Spending: Record every purchase for a month to understand your habits without criticism.

- Pause Before Spending: Ask yourself, “Do I need this? Will it add value to my life?” before making purchases.

- Reflect on Emotional Spending: Notice if you’re using shopping as a coping mechanism for stress or sadness.

Example: If you notice frequent impulse buys, create a 24-hour rule: wait a day before making non-essential purchases to ensure they align with your priorities.

4. Build Financial Resilience

Financial resilience is about preparing for unexpected challenges and bouncing back from setbacks.

Steps to Build Resilience:

- Start an Emergency Fund: Even small contributions, like $10 a week, can create a safety net over time.

- Diversify Income Streams: Explore side hustles or freelance opportunities to boost income.

- Cut Unnecessary Expenses: Review subscriptions, dining out, or other discretionary spending to free up cash.

Example: If saving feels impossible, automate small transfers into a savings account each payday. Even $5 per paycheck adds up over time.

5. Seek Support and Professional Guidance

Financial stress can feel isolating, but you don’t have to face it alone. Seeking support can provide clarity and relief.

Sources of Support:

- Therapists: A therapist specializing in financial stress can help you address underlying anxiety and reframe your mindset around money.

- Credit Counselors: Nonprofit organizations like the National Foundation for Credit Counseling offer free or low-cost financial advice.

- Support Groups: Joining groups focused on financial literacy or debt recovery can provide encouragement and accountability.

Example: If you’re struggling with financial shame, therapy can help you explore its roots and develop healthier self-talk.

6. Incorporate Stress-Relief Practices

Managing your mental health is just as important as addressing the financial side of stress.

Effective Stress-Relief Practices:

- Exercise: Regular physical activity reduces cortisol and boosts mood, helping you cope with stress.

- Breathing Exercises: Practices like diaphragmatic breathing calm the nervous system and reduce anxiety.

- Journaling: Writing down your worries and successes can help you process emotions and track progress.

Research Insight: A study published in Health Psychology found that individuals who exercised for just 30 minutes three times a week reported 25% lower stress levels.

7. Focus on Gratitude and Progress

Focusing on what’s going well—even amidst financial struggles—can help shift your perspective from scarcity to abundance.

How to Cultivate Gratitude:

- List Positives: Each day, write down three things you’re grateful for, such as steady income, supportive friends, or small victories.

- Celebrate Progress: Acknowledge milestones, like paying off a bill or sticking to your budget for a week.

- Practice Visualization: Picture yourself achieving financial stability and how that will feel.

Example: Instead of dwelling on how much debt remains, celebrate paying down even a small amount: “I’m one step closer to my goal.”

Long-Term Strategies for Financial Stability

Overcoming financial stress is a journey. By focusing on long-term habits and planning, you can create a sustainable foundation for the future.

1. Invest in Financial Education

- Take online courses or read books on personal finance, such as The Total Money Makeover by Dave Ramsey or I Will Teach You to Be Rich by Ramit Sethi.

- Follow trusted financial experts for actionable tips.

2. Regularly Review Your Plan

- Set monthly check-ins to assess your budget, savings, and progress toward goals.

- Adjust your plan as your circumstances change.

3. Adopt a Growth Mindset

- View financial setbacks as learning opportunities rather than failures.

- Celebrate each effort you make, no matter how small.

A Balanced Approach to Money and Mental Health

Overcoming financial stress is about more than balancing your budget—it’s about balancing your life. Start by taking small, manageable steps toward financial stability while prioritizing your mental well-being. Remember, progress is better than perfection.

By combining practical financial strategies with tools to nurture your mental health, you can reduce anxiety, build resilience, and regain control over your finances. The path to stability may take time, but each step forward brings you closer to a future of greater peace, confidence, and possibility.

You’re not defined by your financial challenges. With patience, planning, and support, you can create a life that feels not only secure but also fulfilling.

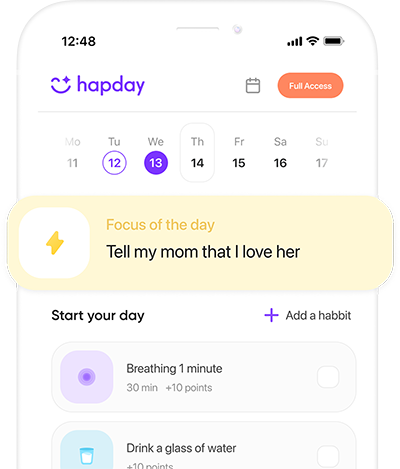

Overcome stress with Hapday, Your Wellbeing Assistant

Join the millions of people using Hapday. Improve overall wellness & sleep.